Tax Bill Explained

Part 1: The new brackets

Part 1: The new brackets

Part 2: Deduction Changes

Part 3: The Big Winners

Disclaimer: The examples provided are for illustrative purposes. Individuals should consult a tax professional regarding their unique financial position

The Brackets:

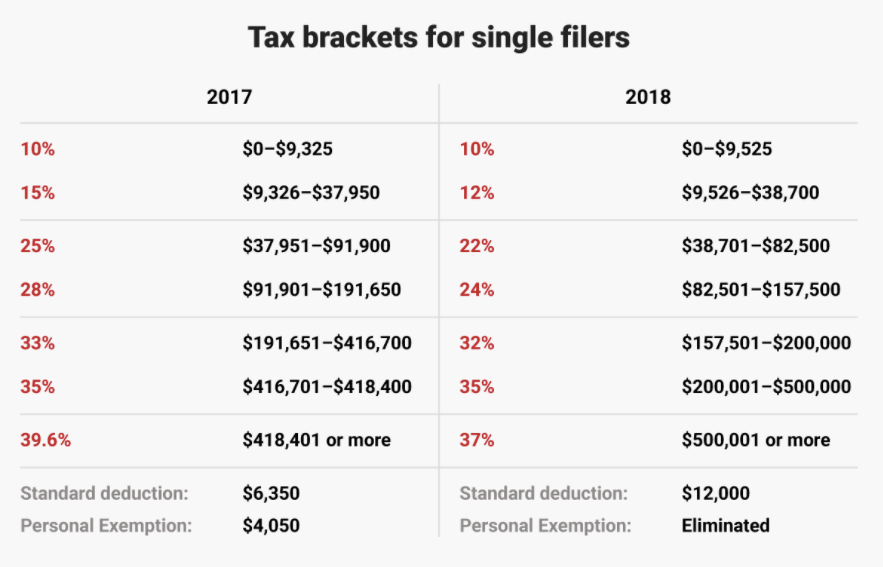

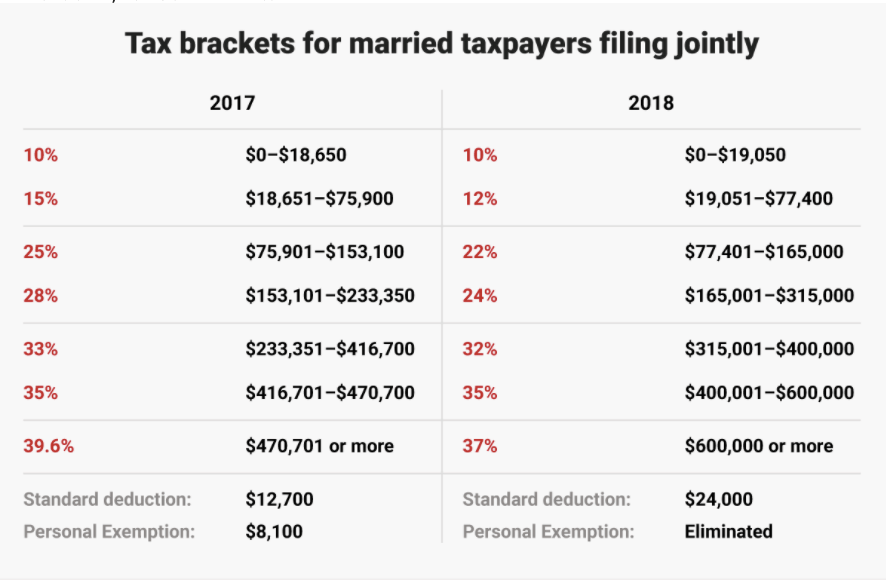

In comparison to the old tax brackets, the new rates are slightly lower and the brackets are broader. In simple terms, the new tax brackets as a whole, will save most people some money, which is always great. What’s important to look at is where you were last year (what tax bracket) and if this year was a mirror image, what would happen under the tax cuts and jobs act.

For example, if you were filing single and earned $157,000 under the new tax brackets, you would pay 24% in taxes, or $37,680, giving you a net of $119,200. Last year you would have paid 28%, ($43,960) netting you $113,040. So now in 2018, you have $6,160 more in your pocket. That’s a new car payment, a vacation or money you can put into a retirement account, all good stuff that will trigger spending and/or investing which boosts the overall economy. However, by making just 3,000 more, $160,000, you fall into the 32% tax bracket in 2018 and were still in the 28% bracket in 2017. So by making $3,000 more, you only bring home $108,800 in 2018 ($160,000 – $51,200 )versus $111,200 in 2017. In this case, you took a 4% hit in net income ( 2017 income on 160k= $111,200 vs. 2018: 108,800). In that scenario, you would earn $2,400 less under the new tax brackets.

Here’s another quick example:

Johnny made $40,000 as a single tax payer in 2017. His tax rate was 25%, paying $5,739 in taxes. Under the 2018 tax bracket, Johnny is now only paying $4,740 in taxes (22%), giving him an extra $999 to save or spend. That’s just on the tax bracket side of things as Johnny will also benefit from the increase in standard deductions.

As you can see in the diagram, they have doubled the standard deductions and eliminated the personal exemptions. Being that 70% of American’s don’t itemize their deductions, this is also an added savings for most.

Deductions

Tax brackets, rates and credits play a large role in how much a taxpayer will pay, but the amount of taxable income plays an EVEN BIGGER role. So here’s a very simple reference for my readers to know and understand about the new law:

- Personal and dependent exemptions are eliminated. However, child tax credits have increased through 2025. The TCJA increases the maximum child tax credit from $1,000 to $2,000 per child. The refundable portion of the credit increases from $1,000 to $1,400. So taxpayers who don’t owe tax can still get a credit of up to $1,400. The higher child tax credit will be available for qualifying children under the age of 17 (as under current law). In addition, the TCJA allows a new $500 credit for dependents who do not qualify for the child tax credit. These are children who are too old for the child tax credit, or non-child dependents. No social security number is required, you can cliam the credit using an Individual Tax Identification Number (ITIN) or and Adoption Tax Identification Number (ATIN).

- Standard Deductions Increase

- $12,000 (single)

- $18,000 (head of household)

- $24,000 (married filing jointly)

This means you don’t have to file a schedule A. That said, you may want to continue to track your expenses so you know whether or or not the standard deduction or itemized deduction process favors you more.

- Changes to Itemized Deductions:

Fully eliminated:

- Employee business expenses

- Tax preparation fees

- Investment interest expenses

- Personal casualty and theft losses (with the exception of federally declared disasters)

- Moving expenses (minus US military required relocation)

- Alimony- no longer deductible AND the spouse receiving alimony does not have to report alimony as income

Limitations put on old deductions: it’s very evident, one is encouraged to use the new standard deductions offered vs itemization. If you’re one of the 30% of American’s that used itemized deductions, you need to know what has been modified or eliminated.

Limited:

- SALT Tax (state and local tax): still deductible but only up to a combined total limit of $10,000 ($5,000 if MFS). This can make a difference in high taxed states like New York or California

- Mortgage Interest

- Limited to interest paid on up to a $750,000 mortgage ($375,000 if MFS) on a mortgage taken after 12/14/2017

- Home Equity Loans- The final bill repeals the deduction for interest paid on home equity debt through 12/31/25. Interest is still deductible on home equity loans (or second mortgages) if the proceeds are used to substantially improve the residence.

- If you’ve taken out a mortgage prior to 12/15/2017, you can deduct mortgage interest up to a $1MM mortgage moving forward. That applies if you refinanced your mortgage prior to 12/15/2017 ($550k if MFS)

Modifications

- Medical expenses- still deductible to the extent they exceed 7.5% of AGI (adjusted gross income)

- Charitable contributions: These have expanded. You may contribute up to 60% of your AGI, up 10% from the former 50% number

Unchanged

- IRA deduction

- Health Savings Account deduction

- Student loan interest

- Educator expense deduction ($250 for unreimbursed classroom supplies)

- Deductions for the self-employed (self-employment tax, health insurance, qualified retirement contributions etc)

Notables:

- You can continue to claim the American Opportunity Credit of up to $2,500 per year for the first 4 years of college education. In addition, you can still earn the lifetime learning credit of up to $2,000 per year for education expenses

- 529 plans may now be used for K-12 expenses- plans can distribute up to $10,000 each year for tuition related to public or private education

- The Obama administration’s health care penalty for those not enrolled in a health care plan has been eliminated

The Biggest Winners of the Tax Cuts & Jobs Act: Businesses

There are two primary types of businesses:

- Corporations- C-Corps. These businesses pay corporate tax using the corporate tax brackets. They pay dividends to their shareholders who are then taxed on their gains

- Pass Through entities: LLC’s, Sole Proprietors, S-Corps and Partnerships. In this business structure, the business does not pay taxes. The profits of these businesses are “passed through” to the owner(s) whom are taxed on the individual tax bracket schedule.

Corporations “C-Corps”:

With the intent to create more jobs and keep American businesses from moving offshore, C-Corps will go from paying 35% to 21% in corporate taxes. Truly the top win in the new bill, corporations are encouraged to deliver more jobs, keep their businesses on US soil and subsequently a greater overall tax base for this country. One set of beliefs is that this needed to be done to grow America; that doing business in America was costing many American businesses millions and in some cases, billions of dollars; vs heading overseas and employing foreign employees while paying substantially less in taxes. The flip side argument is that it’s merely taking away entitlement programs and supplying the top 1% with a substantial boost in income and shareholder wealth. The fact, which is what I present to my readers is from a historical perspective, growth in American business means growth to main street USA. Growth in Main-street USA is undeniably critical to balance our economy.

2n Place Prize: Pass-Through Business Owners: pass-through businesses will receive a 20% deduction on their income. So if you are Suzie Creamcheese LLC and you, after all of your legal business expenses, show a $100,000 profit to your business, you now get an additional 20% tax savings; taking your adjusted income to $80,000.00. In addition, at $80,000 income are also saving an additional 3% on the newly introduced tax brackets. If you’re a small business owner, I encourage you to click on the link below in addition to having a clear meeting with your accountant. You should learn some of the particulars and restrictions as certain industries have limitations to this new law, it’s not a blanket 20% for all small business owners:

Summary:

Overall we will be paying less in taxes. This should in turn generate spending and the opportunity for businesses to employ more people, which historically equates to a stable economy. These changes as it relates to the real estate and mortgage industries should end in:

- Increased prices on homes

- More inventory

- Higher interest rates

To my readers that are considering buying, my recommendation is to do it sooner than later. For my sellers, know the market value of your home, contact me if you don’t know it and I will help you. Your home is a tremendous asset and being informed always provides you with the knowledge you’ll need to make educated decisions. Thank you very much for reading my blog; I hope you find value in my research.

Do you have old debt you are not sure how to handle?

If a collection agency tries to collect on an old debt, what do I do?

If a collection agency tries to collect on an old debt, what do I do?

So many good people experience times in their lives where they face financial adversity. The 2008 recession in particular impacted millions of people. Throughout the course of my career I’ve had to set many people straight on the topic of old debt that I thought I would blog on the topic in hopes to help more people understand their rights and how to make educated decisions.

Step 1: Obtain your credit report. You can do this for free once per year simply by going to www.annualcreditreport.com

Here you will have what is on the three big credit bureau’s: Equifax, Transunion and Experian.

Go thru your entire report with a highlighter and highlight anything derogatory and all “old debt” items you see. Now, you may be surprised on some of the dates you see. For example, let’s say you had a credit card debt of $10,000 dating back to 2008 and the credit card company turned your account off in 2009 and began their collection process. Now you see that same “old debt” but the date says it’s a debt where they stared collections in 2013. How can that be right? Read on.

Step 2: Find your state’s Statute of Limitations. In short, what this means is how long your creditors have to collect on your debt. So go back to the $10,000 credit card debt from 2009. If your state has a statute of limitations of 6 years, they can only go after you until 2015. But now it’s 2017 and you’re still getting collection calls and/or threatening letters in the mail. So many people ask me, “how can they just adjust the date beyond the statute of limitations”? The answer is they can’t, but in the next point I’ll explain what happens.

Step 3: Find out if a law office or attorney bought your debt! It doesn’t have to be a law firm; in fact, many of these companies are nothing more than sales organizations/credit collection companies that simply try to scare people into paying on a debt the original company sold off to them! These are companies that use in many cases, very aggressive, somewhat shady business practices to scare the lights out of you in an effort to collect. They purchased your debt for pennies on the dollar and set up very aggressive campaigns to frighten you into one of a few things: 1. Admitting you owe the debt. When you do this, they “re-age” or what’s called “park” your debt. This is a big reason people see old debt “within the statute of limitations….again…and again…and again”. An illegal practice, especially when the creditor did not notify you in writing that they intend on re-aging your old debt. 2. Say or may any notion that you intend on paying. This can take you backwards and resurface even the oldest of debts. The easiest way to handle these people is to “hang up” on them.

Should you find yourself fighting an old debt, here is my recommendation:

- Do research on the company coming after you. Are they really a legit law firm or posturing themselves as such?

- Write back to them within 35 days of their initial contact. Request verification of the debt. They legally must show proof that you owe them, proof of the actual sum and proof that they are entitled to collect.

- If they are harassing your cell phone, home phone or mailbox, write them a letter to cease all communications with you. They must comply with the Fair Debt Collection Practices Act.

- Dispute any “re-aged” actions you see on your credit report directly with them; and not acknowledging in your letter that you owe the money.

- If you don’t see the date removed on your credit report, you can write directly to the three main credit bureaus directly. They legally must remove it if they do not written confirmation.

Over the years, so many people in these situations simply are not educated on their rights as a consumer. As a result, “old debt” prevents many people from moving forward with their plans to get a mortgage and own the home they wish to live in.

If you need help or advice on this matter, I would be happy to help. Thanks for taking the time to read my blog.

The information on this website is designed to inform and educate only. The views and opinions expressed herein are simply those of the author and do not reflect the policy of my company.

Mortgage Interest Rates

Inflation is a key indicator for where Mortgage Interest Rates are headed. In simple terms, when prices of goods and services go up, investors of mortgage backed securities lose return. That is why when prices rise, so too do interest rates. With the recent jumps in interest rates many projected a steady increase. While I’m not a prognosticator of interest rates, all signs look like they will remain at or near their current levels.

Inventory is getting better. After three consecutive months, pending home sales reversed course in all major regions of the United States with the exception of the Midwest. Almost all regions saw an increase in contract activity according to the National Association of Realtors®.

How about some more good news? As I’m writing this blog the Dow Jones Industrial average hit a record high, approaching the 40,000 mark; powered largely by Goldman Sachs, JP Morgan Chase and a few others.

The economy certainly is showing signs of legitimate growth built on the right foundation.

If you are considering a real estate purchase or are considering getting a mortgage, now is a very good time to act. Historically, rates average around 7-7.5% overall. If you purchase today at today’s costs and property values go up, you can always refinance when rates dip again.

Generation Rent is Ready for Home Ownership!

Tax Liens and Judgements to Come Off Credit Reports

Tax Liens and Judgements to come off many consumer’s credit reports

Tax Liens and Judgements to come off many consumer’s credit reports

Effective July 1st, 2017, Transunion, Equifax and Experian will be excluding tax liens and some civil debts/judgements from consumer’s credit reports. The Consumer Data Industry Organization has stated that this initiative is to ensure consumer identifications are accurate and current.

In a move that will boost many consumers credit scores, the three main credit reporting agencies will remove tax liens and civil debts if reports on those particular obligations do not include: names, addresses, and social security numbers and/or date of birth according to the CDIA.

Federal law requires that accurate information is provided to ensure accurate credit reporting. Consumers have complained that paid debts are still appearing on their credit reports. The National Consumer Assistance Plan will help consumers with prior challenges to obtain loans they otherwise may have been declined.

This is really good news for the housing market obviously, as this news will have an immediate impact on about 10% of Americans. Couple this information with my prior blog on low down/no down payment mortgages and you end up with great news for many people. With the Dow over 20,000, looser credit guidelines and this recent news on credit reporting; times are looking pretty good.

Free credit reports are available through https://www.annualcreditreport.com

Summer 2017 Housing Market Prediction

2017 home sales came out of the blocks strong in January; growing at its fastest rate since 2007. According to the National Association of Realtors®, houses were on the market for an average of just 50 days. In January of 2012, the average turn-around time was 99 days.

Optimism inserts money, primarily investor money, into the marketplace. When investors are optimistic and the stock market rises and shows stability, banks typically loosen their guidelines. Low interest rates, more forgiving mortgage guidelines, low and no down payment mortgage options and rent increases have put the housing market in gear, and it’s just starting to get heated.

Inventory remains the only issue as there is currently just a 3.6-month supply of inventory nationwide; which happens to be the lowest in history. That means if no new houses are listed, by May there would be no existing homes for sale in the market. I expect builders to be licking their chops and that’s a good thing for the housing market. When our country is building, it means people are confident in their futures. Business owners have positive expectations and employees are feeling comfortable with job security which is leading people to look at both new and existing homes. With rental prices increasing, millennials and other first time home buyers are taking advantage of low down and no down payment mortgages.

What about Sellers? Is it a good time to sell?

The simple law of supply and demand tells us that when there is more demand than supply, the value of sellers homes should rise right? Wrong with today’s sellers. Sellers today seem to think the market has reached its peak and prices will be declining. They are acting like we are in an economy on the decline, often taking the first reasonable offer and listing their homes for less than they should. This psychology perhaps is coming from the aftermath of the real estate meltdown as many people are satisfied with “getting out clean” or making very little on their real estate.

If you’re a buyer, you are in POLE POSITION right now; the market favors you. If you’re a seller, consider choosing a Real Estate Agent that properly educates you on real market trends and factual data; you may find that the sale of your home is more lucrative that you think!

Mortgage Guidelines Are Loosening

In the fourth quarter of 2016 we witnessed a great number of mortgage lenders loosen their approval standards. We also saw a spike in interest rates, but if history is an indicator of where interest rates are going for the remainder of 2017, rates should flatten or even perhaps show a slow decrease.

In the fourth quarter of 2016 we witnessed a great number of mortgage lenders loosen their approval standards. We also saw a spike in interest rates, but if history is an indicator of where interest rates are going for the remainder of 2017, rates should flatten or even perhaps show a slow decrease.

Recently sworn in Treasure Secretary Steven Mnuchin stated out of the gate that mortgage rates are likely to stay low for some time. Statements from high ranking officials such as Mr. Mnuchin often keep rates in check. Add historical data to that, when interest rates spike up quickly (they went up 80 basis points from November 2016 to January 2017…which by the way, is one of the largest spikes we’ve seen in such a short amount of time) history shows a long, slow decline in rates. Most people are assuming a continual increase in interest rates, but that very well may not be the case.

The housing market rise and surging stock market has created optimism among lenders. Minimum credit scores have been reduced; documentation for the self-employed has reduced; and maximum loan-to-values have been increased. Banks have also made concessions with individuals with less than perfect credit and have low and no down payment mortgages (VA, USDA, FHA). Today, very few banking institutions create their own lending models. Most will follow the lending guidelines set forth by Fannie Mae and Freddy Mac, in addition to FHA, VA and USDA. What’s loosening are the investor overlays; meaning, if FHA says a minimum FICO score is 525, a banking institution may insert an overlay, bringing the credit guideline to 580.

To support this trend, mortgage processing software firm Ellie Mae has approved 77% of the almost 4 million mortgages they processed last year. The end result is cautious optimism in the US Housing Market.

So what does this mean to you? It means if you’ve been turned down getting a mortgage, you should consider trying again. If you are self-employed and went through a few struggling years after the mortgage melt down, time has passed and banks seem to be prepared to start lending to you again. Whether you’re in the market for a new home or an investment property, 2017 could be a very optimal time for you to act.