Tax Bill Explained

Part 1: The new brackets

Part 1: The new brackets

Part 2: Deduction Changes

Part 3: The Big Winners

Disclaimer: The examples provided are for illustrative purposes. Individuals should consult a tax professional regarding their unique financial position

The Brackets:

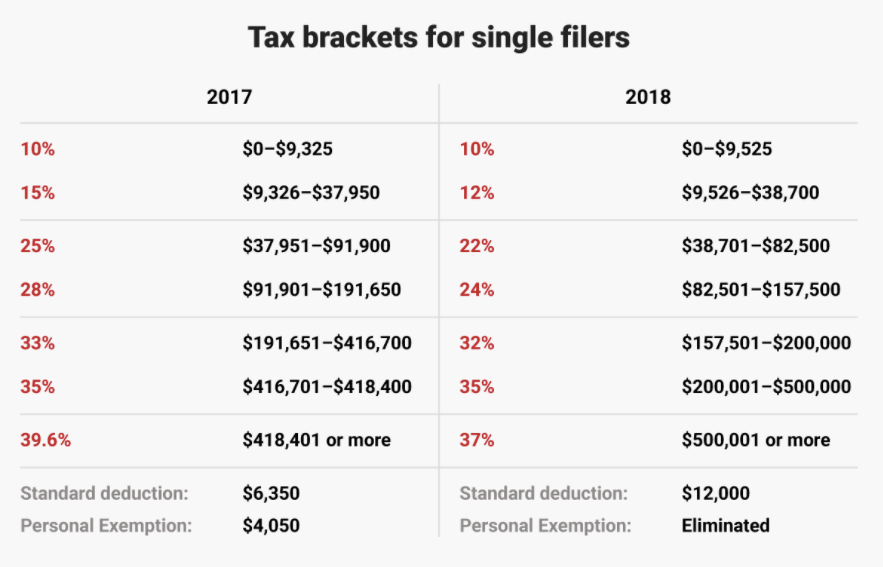

In comparison to the old tax brackets, the new rates are slightly lower and the brackets are broader. In simple terms, the new tax brackets as a whole, will save most people some money, which is always great. What’s important to look at is where you were last year (what tax bracket) and if this year was a mirror image, what would happen under the tax cuts and jobs act.

For example, if you were filing single and earned $157,000 under the new tax brackets, you would pay 24% in taxes, or $37,680, giving you a net of $119,200. Last year you would have paid 28%, ($43,960) netting you $113,040. So now in 2018, you have $6,160 more in your pocket. That’s a new car payment, a vacation or money you can put into a retirement account, all good stuff that will trigger spending and/or investing which boosts the overall economy. However, by making just 3,000 more, $160,000, you fall into the 32% tax bracket in 2018 and were still in the 28% bracket in 2017. So by making $3,000 more, you only bring home $108,800 in 2018 ($160,000 – $51,200 )versus $111,200 in 2017. In this case, you took a 4% hit in net income ( 2017 income on 160k= $111,200 vs. 2018: 108,800). In that scenario, you would earn $2,400 less under the new tax brackets.

Here’s another quick example:

Johnny made $40,000 as a single tax payer in 2017. His tax rate was 25%, paying $5,739 in taxes. Under the 2018 tax bracket, Johnny is now only paying $4,740 in taxes (22%), giving him an extra $999 to save or spend. That’s just on the tax bracket side of things as Johnny will also benefit from the increase in standard deductions.

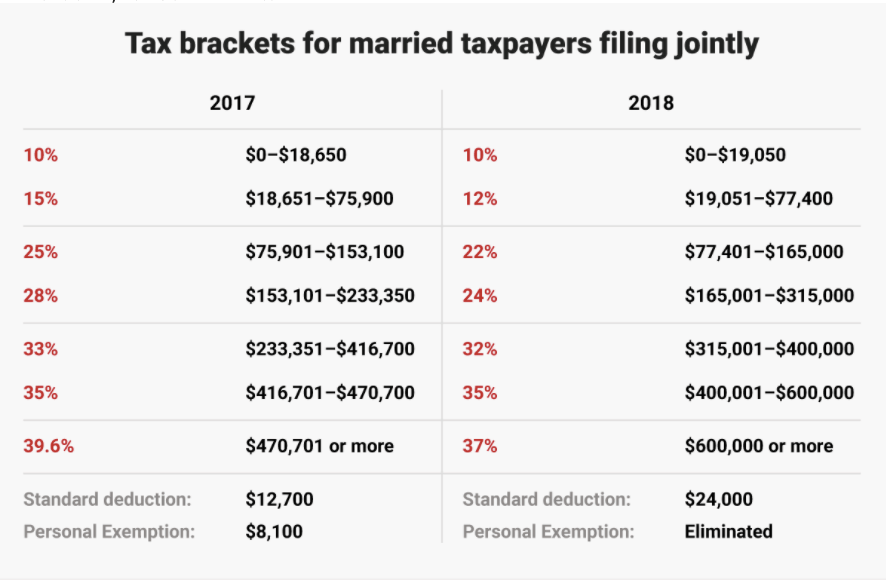

As you can see in the diagram, they have doubled the standard deductions and eliminated the personal exemptions. Being that 70% of American’s don’t itemize their deductions, this is also an added savings for most.

Deductions

Tax brackets, rates and credits play a large role in how much a taxpayer will pay, but the amount of taxable income plays an EVEN BIGGER role. So here’s a very simple reference for my readers to know and understand about the new law:

- Personal and dependent exemptions are eliminated. However, child tax credits have increased through 2025. The TCJA increases the maximum child tax credit from $1,000 to $2,000 per child. The refundable portion of the credit increases from $1,000 to $1,400. So taxpayers who don’t owe tax can still get a credit of up to $1,400. The higher child tax credit will be available for qualifying children under the age of 17 (as under current law). In addition, the TCJA allows a new $500 credit for dependents who do not qualify for the child tax credit. These are children who are too old for the child tax credit, or non-child dependents. No social security number is required, you can cliam the credit using an Individual Tax Identification Number (ITIN) or and Adoption Tax Identification Number (ATIN).

- Standard Deductions Increase

- $12,000 (single)

- $18,000 (head of household)

- $24,000 (married filing jointly)

This means you don’t have to file a schedule A. That said, you may want to continue to track your expenses so you know whether or or not the standard deduction or itemized deduction process favors you more.

- Changes to Itemized Deductions:

Fully eliminated:

- Employee business expenses

- Tax preparation fees

- Investment interest expenses

- Personal casualty and theft losses (with the exception of federally declared disasters)

- Moving expenses (minus US military required relocation)

- Alimony- no longer deductible AND the spouse receiving alimony does not have to report alimony as income

Limitations put on old deductions: it’s very evident, one is encouraged to use the new standard deductions offered vs itemization. If you’re one of the 30% of American’s that used itemized deductions, you need to know what has been modified or eliminated.

Limited:

- SALT Tax (state and local tax): still deductible but only up to a combined total limit of $10,000 ($5,000 if MFS). This can make a difference in high taxed states like New York or California

- Mortgage Interest

- Limited to interest paid on up to a $750,000 mortgage ($375,000 if MFS) on a mortgage taken after 12/14/2017

- Home Equity Loans- The final bill repeals the deduction for interest paid on home equity debt through 12/31/25. Interest is still deductible on home equity loans (or second mortgages) if the proceeds are used to substantially improve the residence.

- If you’ve taken out a mortgage prior to 12/15/2017, you can deduct mortgage interest up to a $1MM mortgage moving forward. That applies if you refinanced your mortgage prior to 12/15/2017 ($550k if MFS)

Modifications

- Medical expenses- still deductible to the extent they exceed 7.5% of AGI (adjusted gross income)

- Charitable contributions: These have expanded. You may contribute up to 60% of your AGI, up 10% from the former 50% number

Unchanged

- IRA deduction

- Health Savings Account deduction

- Student loan interest

- Educator expense deduction ($250 for unreimbursed classroom supplies)

- Deductions for the self-employed (self-employment tax, health insurance, qualified retirement contributions etc)

Notables:

- You can continue to claim the American Opportunity Credit of up to $2,500 per year for the first 4 years of college education. In addition, you can still earn the lifetime learning credit of up to $2,000 per year for education expenses

- 529 plans may now be used for K-12 expenses- plans can distribute up to $10,000 each year for tuition related to public or private education

- The Obama administration’s health care penalty for those not enrolled in a health care plan has been eliminated

The Biggest Winners of the Tax Cuts & Jobs Act: Businesses

There are two primary types of businesses:

- Corporations- C-Corps. These businesses pay corporate tax using the corporate tax brackets. They pay dividends to their shareholders who are then taxed on their gains

- Pass Through entities: LLC’s, Sole Proprietors, S-Corps and Partnerships. In this business structure, the business does not pay taxes. The profits of these businesses are “passed through” to the owner(s) whom are taxed on the individual tax bracket schedule.

Corporations “C-Corps”:

With the intent to create more jobs and keep American businesses from moving offshore, C-Corps will go from paying 35% to 21% in corporate taxes. Truly the top win in the new bill, corporations are encouraged to deliver more jobs, keep their businesses on US soil and subsequently a greater overall tax base for this country. One set of beliefs is that this needed to be done to grow America; that doing business in America was costing many American businesses millions and in some cases, billions of dollars; vs heading overseas and employing foreign employees while paying substantially less in taxes. The flip side argument is that it’s merely taking away entitlement programs and supplying the top 1% with a substantial boost in income and shareholder wealth. The fact, which is what I present to my readers is from a historical perspective, growth in American business means growth to main street USA. Growth in Main-street USA is undeniably critical to balance our economy.

2n Place Prize: Pass-Through Business Owners: pass-through businesses will receive a 20% deduction on their income. So if you are Suzie Creamcheese LLC and you, after all of your legal business expenses, show a $100,000 profit to your business, you now get an additional 20% tax savings; taking your adjusted income to $80,000.00. In addition, at $80,000 income are also saving an additional 3% on the newly introduced tax brackets. If you’re a small business owner, I encourage you to click on the link below in addition to having a clear meeting with your accountant. You should learn some of the particulars and restrictions as certain industries have limitations to this new law, it’s not a blanket 20% for all small business owners:

Summary:

Overall we will be paying less in taxes. This should in turn generate spending and the opportunity for businesses to employ more people, which historically equates to a stable economy. These changes as it relates to the real estate and mortgage industries should end in:

- Increased prices on homes

- More inventory

- Higher interest rates

To my readers that are considering buying, my recommendation is to do it sooner than later. For my sellers, know the market value of your home, contact me if you don’t know it and I will help you. Your home is a tremendous asset and being informed always provides you with the knowledge you’ll need to make educated decisions. Thank you very much for reading my blog; I hope you find value in my research.